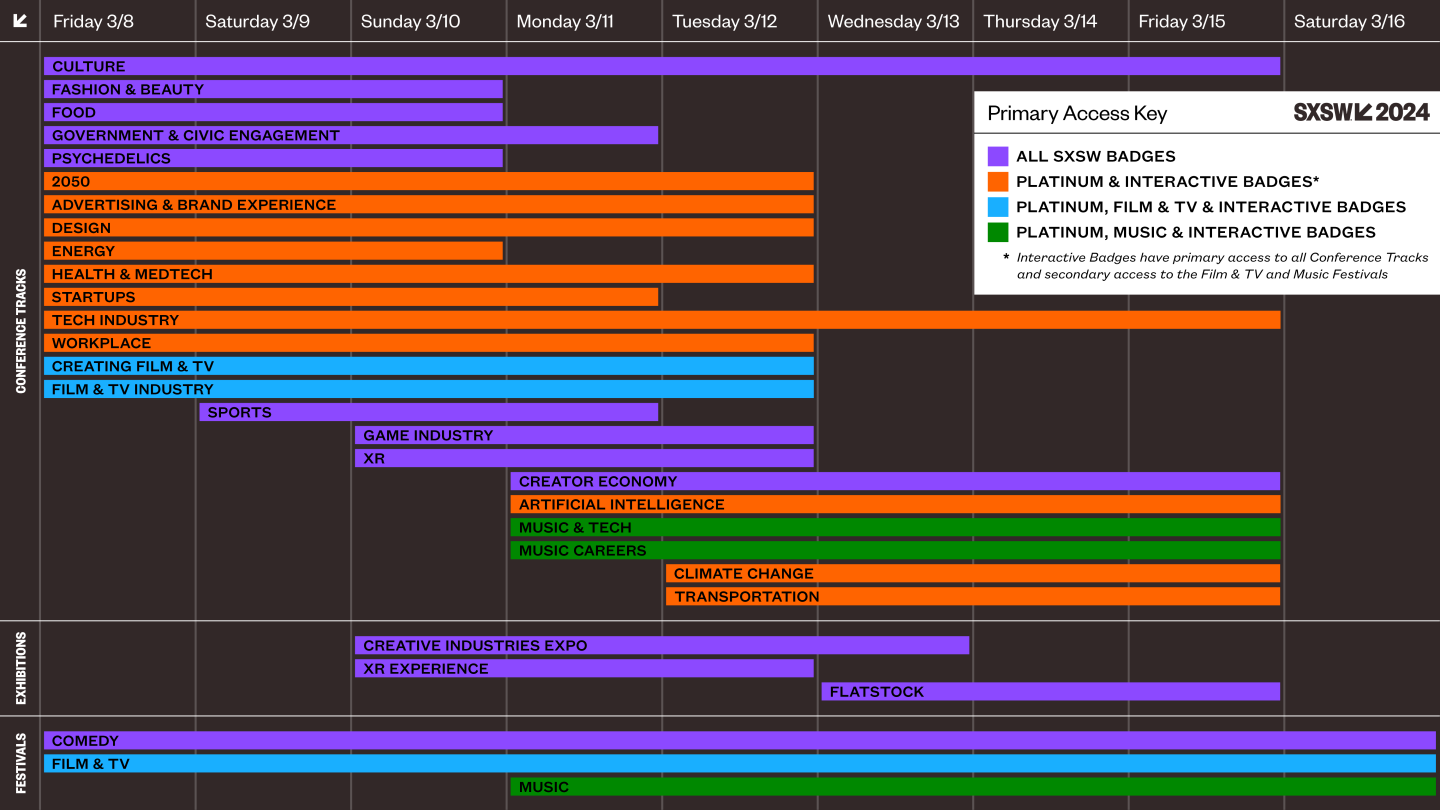

March 8-12

Showcasing long-range, big-picture thinking across interplanetary exploration and quantum to new science discoveries and neurotech breakthroughs, these sessions sneak a peek into the not so distant future.

March 8-12

Geared towards agencies and organizations that want to better understand new ways of connecting with their communities, this programming examines compelling strategies to engage audiences through traditional, digital, and experiential marketing practices.

March 11-15

With AI expanding into all industries, explore the development of this technology and where it’s headed next. Content will focus on the societal implications of AI as well as the ethics around its use.

March 12-15

Explore the most promising ideas on mitigating (or sometimes living with) the effects of global warming and in-depth coverage of the consequences of unpredictable weather patterns and rising ocean levels.

March 8-12

Investigate the creative process behind film and episodic content with an emphasis on the collaborative nature of the medium. Creating Film & TV track sessions include career development, production, storytelling, VFX, and virtual production.

March 11-15

Dive into the most intriguing new ideas in self-produced content, as well as ahead-of-the-curve distribution, monetization strategies and brand alignments for this cutting-edge media sector.

March 8-15

The relationships and engagements we experience from a local to a global scale make our lives more profound and meaningful. This programming, which covers what’s shaping the human experience in modern society, is a foundation of SXSW and runs for the entire eight days of the Conference.

March 8-12

Focusing on the philosophical as well as technical, Design track sessions present the methods which top developers and creatives use to build our digital, virtual, and physical worlds with purpose through intentional design thinking.

March 8-10

An exploration of solutions to energy production and delivery at every scale. From rethinking infrastructure to the continued development of alternative energy sources like thermal and fusion, sessions will tackle different approaches to improve access and equity for communities.

March 8-10

From research, design and manufacturing to logistics, retail and end use, these sessions examine the journey and impact of these industries on our lives.

March 8-12

View the current and future states of film and television through the independent lens of SXSW. With a focus on the business side of the industry, content will cover distribution, financing, representation, and the ever-changing nature of film and television.

March 8-10

Explore how technology and innovation can be leveraged to change the way societies grow, process, cook, consume, and experience food while finding more sustainable and healthy ways to feed the world.

March 10-12

With a focus on the game industry’s continued ascent to dominance as an entertainment platform, programming will emphasize how traditional media and music content is increasingly migrating to these systems.

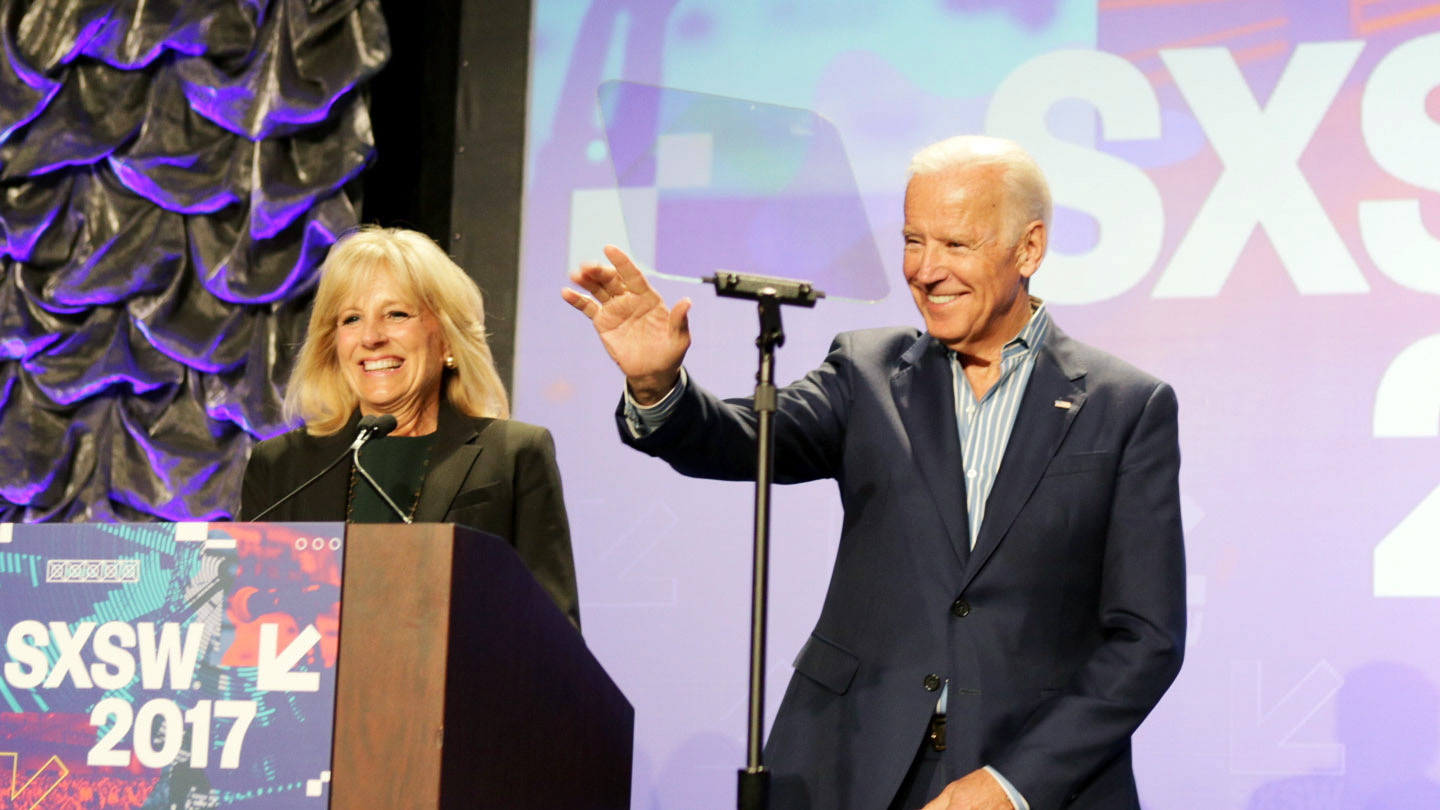

March 8-11

Discussing programs, policy directions, and new ideas for pushing positive change, conversations will also cover the upcoming US elections and different angles on how the media tackles the issues.

March 8-12

Addressing how technological and social changes are impacting one of the world’s largest industries, sessions cover everything from patient-centric care and brain-computer interfaces to health equity and 3D-printed human organs.

March 11-15

From artificial intelligence and virtual pop stars to next-generation streaming services, technology has re-invented the way we create, discover, distribute and experience music. This programming showcases the promise and potential pitfalls of these innovations and trends.

March 11-15

Whether you’re an emerging artist or someone who has spent years in one of the many fields that are part of an ever-changing business landscape, this programming will provide valuable guidance and insights into fast-tracking your trajectory in the music industry.

March 8-11

As therapeutic applications of psychedelics gain more traction in the mainstream consciousness, explore how breakthrough research and a growing business environment will impact the future applications of novel and traditional drugs.

March 9-11

Tackling breakthroughs in technology, data analysis, sports betting, athlete empowerment, fan experiences, and media, these sessions address factors influencing the future of this global industry.

March 8-12

Creating the next big thing is a central theme at SXSW. These sessions cover the unexpected founders, funders, business plans, new revenue models, success stories, and epic fails that make entrepreneurism so compelling.

March 8-15

Featuring the platforms, people, software, hardware and virtual systems that are driving the world’s next wave of change, areas of focus for 2024 include cybersecurity, Web3, the path forward for Big Tech, and Austin's emergence as a major global player in this space. This programming, which is a foundation of SXSW, runs for the entire eight days of the Conference.

March 12-15

Recent and upcoming technological advances are radically transforming the way we get from here to there. While electric vehicles are a major focus, sessions will also examine the evolution of autonomous transport, new aviation breakthroughs, alternative fuels, and the most exciting new ideas in micro-mobility.

March 8-12

Focusing on the continuing evolution of how we work, from physical work spaces and redefining work expectations to executing DEIB environments, this content assesses the impact these changes will have on both employees and employers.

March 10-12

Covering the most exciting immersive breakthroughs from virtual and augmented realities to the intertwining of worlds through the metaverse, this content navigates the potential of these mind-bending experiences through new software and hardware technologies.